Sustainable Capital Investments makes this possible for you and your family to get access to large scale institutional multifamily apartment complexes. In collaboration with a general partner group, Rob and Mallibi are building a real estate investment platform that gives everyone, accredited and non-accredited, beginner and experienced investors, access to the highest-quality real estate investment with a low minimum investment.

We’ve gone full-cycle on 8 multifamily apartment complexes to date and continue to grow the value of the portfolio with an average ROI of 80%- 100% to our investors.

19 apartment complexes

a target hold time of 5 years

Raised total investment capital

(acquired, improved, then sold for a capital gain).

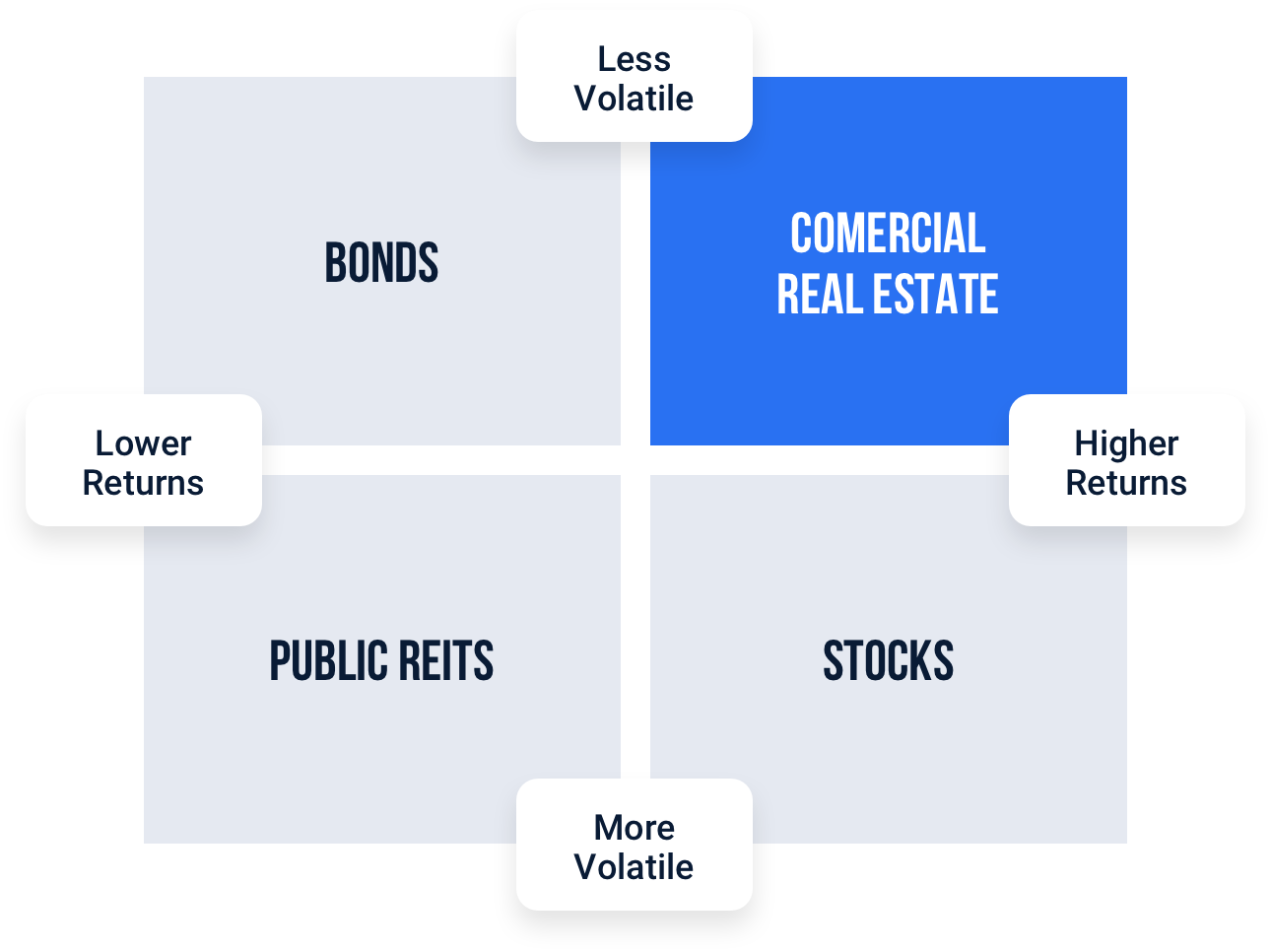

Commercial Real Estate has been a playground for the wealthy and large institutions for generations. We have opened it up to allow real estate investing for everyone. Investments in Multifamily real estate provide essential portfolio diversification, along with the ability to build long-term wealth and can also deliver stable income throughout the life of the investment.

We buy assets in growing markets that are landlord friendly and offers an opportunity for us to add value. At the core, we Implement sustainable practices for the property, community and staff that contributes to a better planet.

Commercial real estate has historically proven to be an attractive hedge against inflation. It is typically a more stable asset class than stocks or bonds, both of which are closely tied to market cycles. Combined with a forecast to strong rent growth, Multifamily Real Estate offers a strong economic outlook for the next few years.

If you’re not investing in real estate, you may be leaving money on the table. Answer just a few qualifying questions to join our circle of investors and you could change your financial trajectory.

Pick a day and time onto our online meeting system and fill out the form with your contact info to sign up for the investor strategy session.

Please respect everyone's time. Calls WILL NOT be rescheduled if you miss your time slot without a prior notice.

We are SEC compliant and require a pre-existing relationship with all our investors. After the initial relationship was established, you'll be granted access to our network and upcoming deals.

Pick a day and time onto our online meeting system and fill out the form with your contact info to sign up for the investor strategy session.

Please respect everyone's time. Calls WILL NOT be rescheduled if you miss your time slot without a prior notice.

We are SEC compliant and require a pre-existing relationship with all our investors. After the initial relationship was established, you'll be granted access to our network and upcoming deals.

We acquire Class A, B multifamily properties with high value-add upside, then reposition them through renovations, branding, and lifestyle improvements.

Our investments are located in high-growth submarkets throughout the Western United States, primarily in rapidly-growing cities like Dallas - Fort Worth, Austin, and Atlanta.